Are you looking for a reliable and secure way to grow your finances? Look no further than Fixed Index Annuities (FIA). At J. Murry Financial, we believe in empowering our clients with the knowledge and tools necessary to make informed financial decisions. In this article, we will explore the benefits of FIAs and how they can help you achieve your financial goals.

What are Fixed Index Annuities (FIA)?

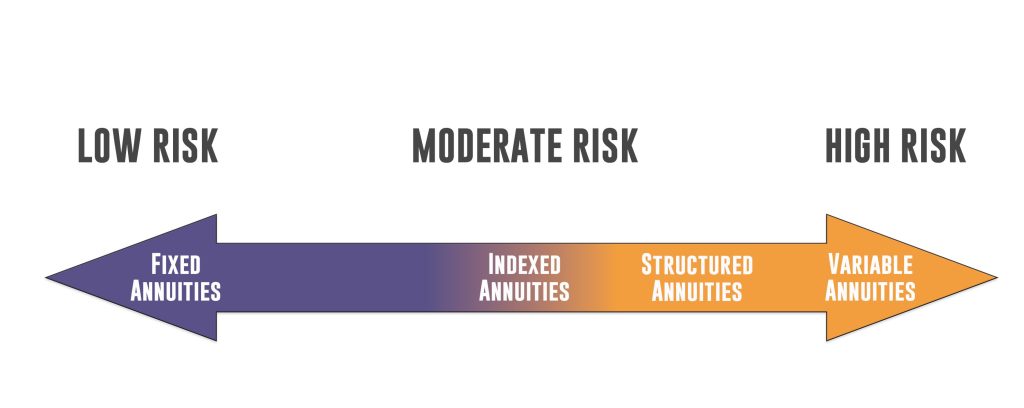

FIAs are insurance products that offer a unique combination of growth potential and downside protection. They provide you with the opportunity to participate in the potential growth of the stock market while protecting your principal from market downturns. This makes FIAs an attractive option for individuals who want to grow their money without the risk of losing it.

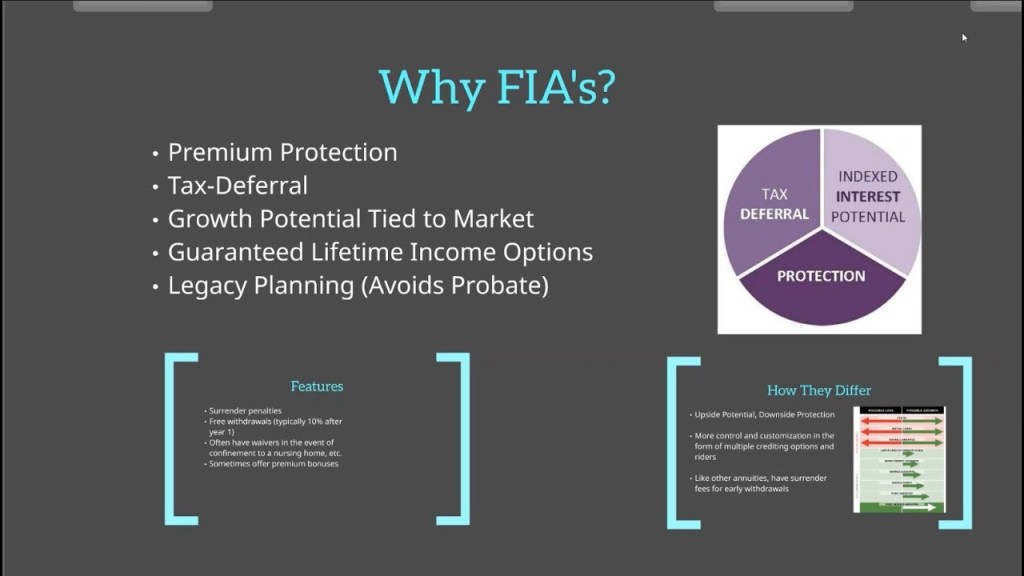

Benefits of Fixed Index Annuities:

- Principal Protection: One of the key advantages of FIAs is that they offer protection for your principal investment. This means that even if the stock market experiences a downturn, your initial investment is safe.

- Growth Potential: FIAs provide the opportunity to earn interest based on the performance of a specific stock market index, such as the S&P 500 & Russell 2000. This allows you to participate in market gains and potentially earn higher returns compared to traditional fixed-rate investments.

- Tax-Deferred Growth: Another benefit of FIAs is that they offer tax-deferred growth. This means that you don’t have to pay taxes on the interest earned until you start withdrawing funds from the annuity. This can be advantageous for individuals looking to maximize their retirement savings.

- Lifetime Income: FIAs can also provide you with a guaranteed stream of income for life. This can be especially beneficial for retirees who want to ensure a stable income during their golden years.

- Flexibility: FIAs offer flexibility in terms of withdrawal options. Depending on the annuity contract, you may have the ability to make partial withdrawals or access your funds without penalty under certain circumstances.

Is a Fixed Index Annuity Right for You?

While FIAs offer numerous benefits, it’s important to consider your individual financial goals and risk tolerance before making any investment decisions. At J. Murry Financial, we take a personalized approach to financial planning and can help you determine if an FIA genuinely aligns with your unique needs or to explore other options for your unique needs.

Take the Next Step:

Ready to explore the benefits of FIAs and unlock your financial growth? Contact Jason D. Murry to schedule a free consultation. Our team of experts is dedicated to helping you achieve your financial goals and providing you with the knowledge and support you need along the way. Together, let’s pave the path to a brighter financial future. #FinancialGrowth #Empowerment #FIAincome #Assets #Investing

Again, FIAs are mid-risk investments primarily benefit the clients who desire to Protect their Initial Premiums, have Growth Potential through Stock Market Indices such as; the S&P 500 and Russell 2000, Tax-Deferred Growth, Lifetime Income, Flexible Withdrawals, & to Avoid Probate.

Remember, at J. Murry Financial, we’re here to guide you on your financial journey and help you make informed decisions. Contact us today to learn more about the benefits of FIAs and how they can support your financial goals. Let’s work together to unlock your full financial potential. #FinancialSuccess #Empowerment