How Many North Americans Experience Financial Vulnerability:

The financial landscape in America today paints a picture of growing uncertainty and vulnerability for many. Amidst the backdrop of a global pandemic, economic shifts have led to significant job layoffs, leaving countless individuals and families grappling with the immediate loss of income and the looming fear of what the future holds. This instability is compounded by concerns over the sustainability of social security, with projections suggesting that funds may be depleted by 2035. Such uncertainties underscore the critical need for comprehensive financial planning and literacy.

Moreover, the specter of high inflation has cast a long shadow over the cost of living, affecting everything from grocery bills to housing costs. This inflationary pressure, coupled with wages that have largely remained stagnant, has pushed an alarming 70% of American families into a cycle of living paycheck to paycheck since 2021. The immediate consequence of this financial precarity is not just the struggle to meet day-to-day expenses but also the inability to save for future needs or emergencies, leaving many just one unexpected expense away from financial crisis.

These challenges highlight the urgency of enhancing financial literacy and planning among Americans. Understanding how to navigate these turbulent financial waters is more than just a matter of personal security; it’s about building a foundation for future stability and prosperity. By focusing on financial education and leveraging innovative financial tools, individuals can gain the knowledge and confidence needed to make informed decisions about their financial futures. This is where the importance of accessible, clear, and empathetic financial advice becomes paramount, setting the stage for a journey toward financial empowerment and resilience.

An In-Depth Example of Living Paycheck to Paycheck:

Living paycheck to paycheck has become an all-too-common reality for a significant portion of Americans, a situation where individuals and families find themselves with just enough income to cover their monthly expenses, leaving little to no room for savings or unexpected costs. This financial tightrope walk is primarily driven by a combination of stagnant wages and the rising cost of living, exacerbated by persistent inflation. As prices for essentials like housing, healthcare, and groceries increase, salaries have not kept pace, forcing many to allocate a larger portion of their income to meet these basic needs.

The impact of inflation on everyday expenses cannot be overstated. It chips away at purchasing power, meaning that even if nominal wage increases occur, they may not be sufficient to keep up with the cost of living. This scenario places additional strain on already stretched budgets, making it difficult to set aside funds for emergencies or future financial goals. In such an environment, the absence of a financial buffer can lead to a cycle of debt, as people may resort to credit cards or loans to cover unexpected expenses, further exacerbating their financial precarity.

However, there are strategies to mitigate the effects of living paycheck to paycheck. Effective budgeting is the first step, requiring a clear understanding of income and expenses to identify areas where costs can be reduced. Creating an emergency fund, even with small, regular contributions, can provide a safety net for unforeseen expenses, reducing the need to incur debt. Additionally, leveraging financial tools and resources can offer insights into managing finances more effectively. For instance, Experior’s innovative tools, like FiN, can help individuals understand their financial situation better and make informed decisions about saving, spending, and investing.

While the challenges of living paycheck to paycheck are significant, they are not insurmountable. With the right approach to budgeting, savings, and the use of financial planning tools, individuals can create a buffer against financial instability, paving the way towards greater financial security and independence. It’s about making informed choices and taking proactive steps to manage one’s financial health, even in the face of economic uncertainties.

The Life Insurance Gap: The Risk:

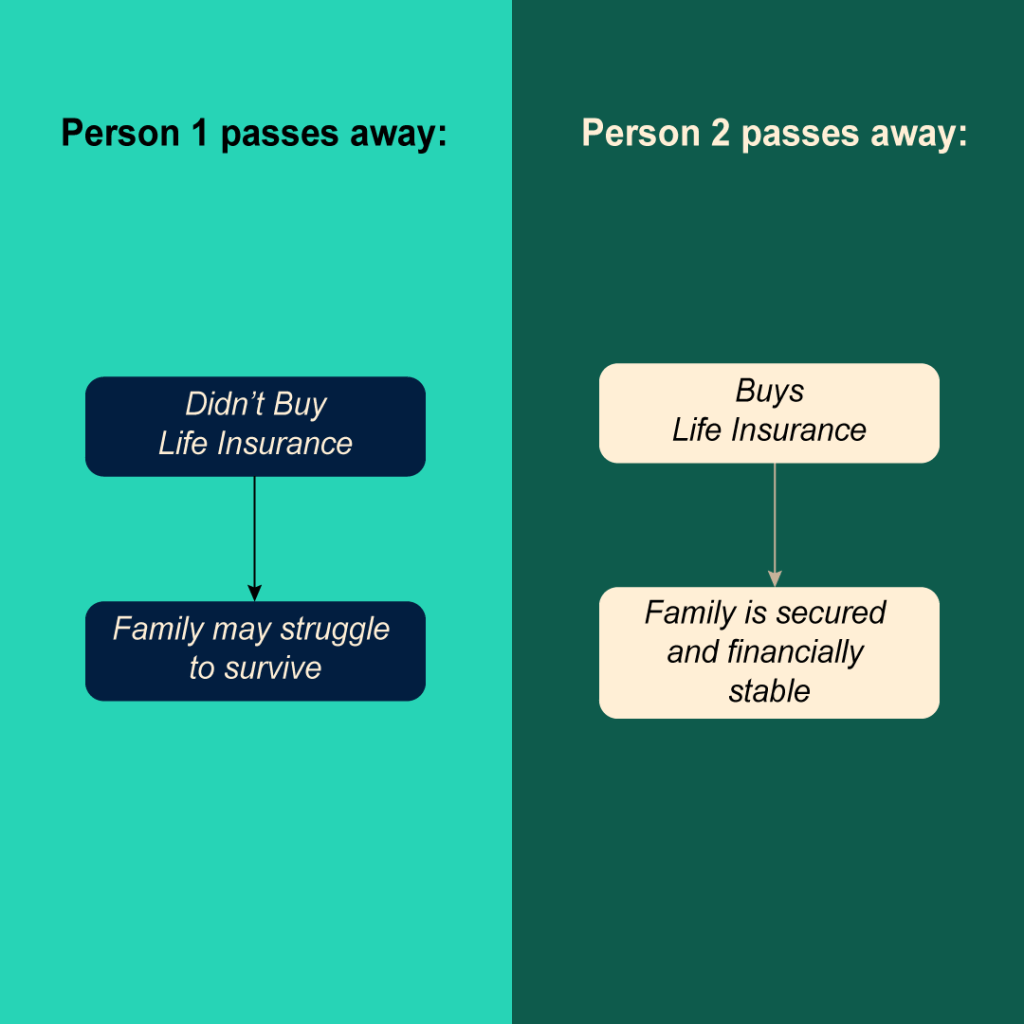

Life insurance often gets overlooked in financial planning discussions, yet it plays a pivotal role in securing the financial future of families. It’s designed to provide a safety net, ensuring that in the event of an unexpected loss, the financial well-being of loved ones is preserved. Despite its importance, a significant portion of Americans remain underinsured or without any life insurance coverage at all. This gap in coverage can lead to devastating financial consequences, leaving families struggling to cope with expenses like mortgages, education costs, and daily living expenses in the absence of the deceased’s income.

There are several types of life insurance, each catering to different needs and life stages. Term life insurance, for instance, offers coverage for a specified period and is often a cost-effective option for young families. On the other hand, whole life insurance provides lifelong coverage along with a cash value component, which can be a valuable asset for long-term financial planning. Despite the variety of options available, many Americans shy away from purchasing life insurance due to misconceptions about its cost and the complexity of obtaining coverage. However, with the right guidance, finding a policy that fits one’s needs and budget can be straightforward and accessible.

Addressing common misconceptions is crucial in closing the life insurance gap. Many believe that life insurance is too expensive, yet the reality is that coverage can be quite affordable, especially for term life policies. Another barrier is the perception that the application process is cumbersome and time-consuming. Advances in technology have streamlined this process, making it easier than ever to apply for and obtain life insurance. By demystifying these aspects and highlighting the critical role of life insurance in a comprehensive financial plan, individuals can be encouraged to evaluate their coverage needs proactively.

Understanding one’s life insurance needs is a personal process and requires consideration of various factors, including financial obligations, dependents, and future goals. Tools like Experior’s innovative financial planning platforms can assist in this evaluation, providing insights and recommendations tailored to individual circumstances. By leveraging such resources, individuals can make informed decisions about the type and amount of life insurance that best suits their needs, ensuring their loved ones are protected against financial hardship in the face of life’s uncertainties.

In conclusion, life insurance is an essential component of a robust financial plan, offering peace of mind and security for the future. By educating individuals about the types of life insurance available, addressing misconceptions, and providing tools for evaluating coverage needs, we can bridge the gap in life insurance coverage and ensure that more families are protected against the financial impact of unexpected loss.

Retirement Planning in Uncertain Times:

Navigating the path to retirement has become increasingly complex, especially with growing concerns that social security funds might be insufficient in the near future. Coupled with the fact that many Americans are outliving their savings and 401(k)s, the need for strategic retirement planning has never been more critical. Assessing retirement readiness involves a thorough evaluation of current savings, projected expenses, and expected income sources in retirement. It’s about understanding not just how much you have saved, but also how long those savings will last given your lifestyle and the rising costs of healthcare and living expenses.

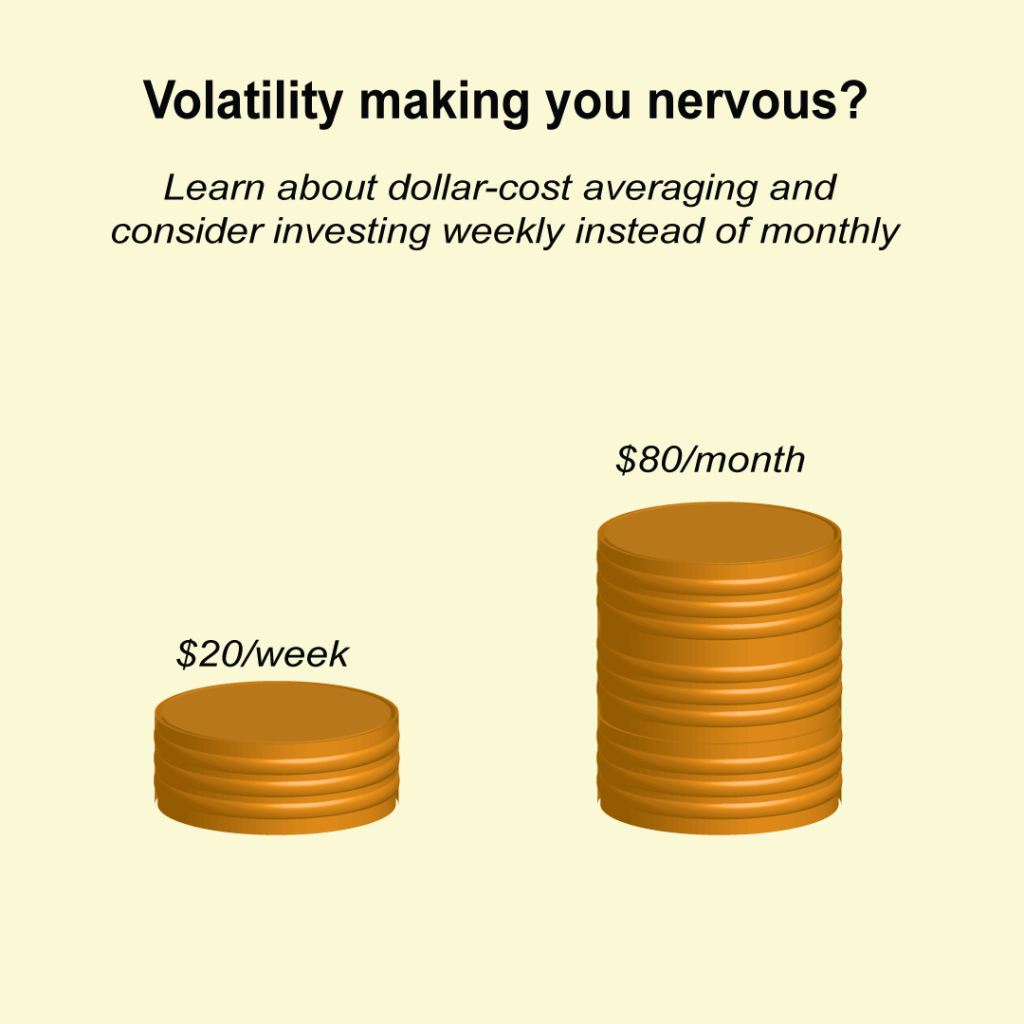

Diversifying retirement income sources is a key strategy in building a more secure financial future. Beyond traditional savings and social security benefits, exploring other income streams such as investments, annuities, or even part-time work in retirement can provide additional financial cushioning. This diversification helps mitigate risks, such as market volatility or longer-than-expected lifespans, ensuring that you have a steady flow of income throughout your retirement years.

Innovative tools, like FiN, offer valuable assistance in this planning process. FiN can help individuals understand their current financial situation, project future needs, and identify potential gaps in their retirement planning. By providing insights into various income sources and how they can be optimized for retirement, these tools empower users to make informed decisions that align with their long-term goals. Moreover, they encourage a proactive approach to retirement planning, highlighting the importance of starting early and adjusting plans as circumstances change.

In the face of uncertainties surrounding social security and the adequacy of savings, taking control of your retirement planning is essential. It’s about looking beyond the immediate horizon and laying the groundwork for a future that is both financially secure and aligned with your personal aspirations. With the right knowledge and tools, such as those offered by J. Murry Financial through Experior, individuals can navigate the complexities of retirement planning with confidence, ensuring they are well-prepared to enjoy their retirement years to the fullest.

The journey to a sustainable retirement requires both foresight and adaptability. By assessing retirement readiness, diversifying income sources, and leveraging advanced financial planning tools, individuals can build a retirement plan that not only withstands the test of time but also provides peace of mind. In an era marked by financial uncertainties, such preparedness is invaluable, offering a path to retirement that is both achievable and rewarding.

The Side Hustle Solution:

In today’s economic climate, where the cost of living continues to rise and traditional employment often falls short of covering all financial needs, exploring additional income streams has become a necessity for many. Side hustles, or secondary forms of employment taken on in addition to full-time jobs, offer a practical solution. They not only provide an extra layer of financial security but also present an opportunity for individuals to pursue passions or interests that may not be fulfilled in their primary careers. From freelance writing and graphic design to driving for ride-share companies or selling handmade goods online, the possibilities for side hustles are as diverse as the individuals pursuing them.

However, embarking on a side hustle comes with its own set of challenges. Time management, for instance, becomes crucial as individuals must juggle the responsibilities of their full-time job with the demands of their secondary employment. There’s also the risk of burnout, as dedicating additional hours to work can lead to stress and fatigue. To mitigate these challenges, it’s important to choose a side hustle that aligns with personal interests or skills, as this can make the extra work feel less burdensome and more like a fulfilling endeavor. Setting clear boundaries and dedicating specific times for the side hustle can also help maintain a healthy work-life balance.

For those considering a side hustle, the key is to start small and scale up gradually. This approach allows for learning and adjustment without overwhelming the individual. It’s also beneficial to leverage online platforms and social media to market the side hustle, reaching a wider audience without significant upfront costs. As the side hustle grows, it can become a significant source of income, offering not just financial stability but also the potential for full-time entrepreneurship.

In conclusion, side hustles represent a viable option for financial empowerment, allowing individuals to supplement their income and pursue their passions. With careful planning and dedication, a side hustle can transform from a simple means to make ends meet into a fulfilling career path. For those navigating the complexities of the modern financial landscape, considering a side hustle could be the key to achieving both economic stability and personal satisfaction.

What Now? I’m Glad You Asked:

The journey toward financial stability and empowerment is both necessary and achievable. As we’ve explored, the challenges of living paycheck to paycheck, the critical importance of life insurance, the complexities of retirement planning, and the potential of side hustles offer significant opportunities for individuals to enhance their financial literacy and take control of their future. Each of these areas, while distinct, shares a common thread: the need for proactive planning and the value of informed decision-making.

Empowering yourself financially means understanding the landscape, recognizing the risks, and taking steps to mitigate those risks. It’s about making choices today that will secure your tomorrow. This could mean reassessing your life insurance coverage to ensure your family’s future is protected, diversifying your income sources to build a more resilient financial foundation, or leveraging advanced tools to plan for a retirement that’s not just sustainable but also fulfilling.

Remember, you’re not alone in this journey. At J Murry Financial, we’re committed to providing personalized advice and support, helping you navigate the complexities of the financial world with confidence. Our partnership with Experior Financial Group & Global View Capitol Advisors equips us with innovative tools and resources designed to offer insights and solutions tailored to your unique situation. Whether you’re looking to better understand your financial health, explore insurance options, or plan for retirement, we’re here to help.

We invite you to take the next step toward financial empowerment. Reach out to us for a conversation about how we can support your goals and help you build a stronger, more secure financial future. Together, we can turn challenges into opportunities and aspirations into achievements.

Jason Murry

Founder, J Murry Financial