Just as a disciplined offensive strategy can function as defense in a fight, proactive financial planning serves as protection and forward momentum for martial arts school owners and business leaders.

Many instructors and entrepreneurs launch with passion, but passion without structure creates vulnerability. In the U.S., survival data underscores the stakes: the SBA Office of Advocacy reports an average five-year survival rate of about 49% for new employer establishments (1994–2019), and a ten-year survival rate around 34%.[1] BLS reporting also highlights the long-horizon reality: only about one-third of establishments in a 2013 birth cohort were still operating a decade later.[2]

Offense Is Defense: Why Financial Planning Matters

In martial arts, strong offense can preempt an opponent’s attack. In business, proactive financial planning is often the difference between absorbing impact and being knocked out. Business survival data shows that early years are volatile and long-term survival is not guaranteed—reinforcing why leaders must build both protection and a growth system.[1] [2]

This principle is especially visible in the martial arts industry through the pandemic era. Some schools did nothing and closed, many survived by defending, and a smaller group adapted aggressively and grew by going “on offense” during disruption.[3] Industry commentary and reports also describe broad closures and severe pressure on dojos during lockdowns, highlighting the need for reserves and systems.[4]

Financial planning is not only about keeping the doors open; it’s also about leadership stability. Leaders operating under constant financial stress can burn out, make reactive decisions, and reduce the quality of instruction and culture over time. Offense-as-defense means you plan ahead so you don’t lead from panic.

The Financial Fight Framework

Use this “Financial Fight” structure to compare leaders who operate with a plan versus those who do not:

Financial Stance (Protection)

Your stance is your base: protection, structure, and preparedness. If you lose your stance, everything else collapses.

- Life Insurance (family protection + continuity)

- Legal Protection (entity structure, liability strategy)

- Estate Planning (will, trust, succession planning)

Financial Movement (Stability)

Movement keeps you balanced. In finances, movement is cash flow discipline, debt control, and credit strength.

- Debt Elimination

- Credit Repair

- Debt Leveraging (strategic, ROI-driven borrowing)

Financial Attack (Wealth & Legacy)

Attack is where you build capacity: savings, retirement strategy, and legacy planning for the next generation.

- Savings (reserves + opportunity capital)

- Retirement

- Legacy Planning

Financial Stance: Protect Your Base (Defense)

Life Insurance & Business Continuity

If a dojo owner, partner, or key leader dies or becomes incapacitated, the business can enter a rapid destabilization cycle: revenue disruption, unpaid obligations, and loss of operational leadership. One widely used continuity tool is key person insurance— a life policy purchased by the business on a vital individual, with the company as beneficiary, designed to protect against financial loss.[5] Guardian also describes key person coverage as a tool to help businesses recover from the financial loss caused by the death of an owner, partner, or essential employee and to provide time to find/train replacements.[6]

Legal Protection (Structure & Liability)

Martial arts training is inherently physical. Risk exists even with excellent safety protocols. Legal structure (LLC/corporation, proper contracts and waivers, policies) and appropriate insurance coverage help prevent a single event from becoming a financial knockout. Planning your legal posture is part of a disciplined stance.

Estate Planning & Succession

Estate planning is not merely a personal matter; for business owners it is operational continuity. Gallup’s research on succession highlights that many small-business owners lack formal succession planning, and the picture differs sharply between employer firms and nonemployer businesses—underscoring how frequently owners are unsure what happens next.[7] The SBA Office of Advocacy also emphasizes survival dynamics over time—reinforcing why business owners should not assume longevity without structure.[1]

Financial Movement: Footwork for Stability (Debt & Credit)

Debt Elimination

High-interest consumer debt and reactive borrowing reduce strategic flexibility. When debt payments rise, decision-making becomes constrained; marketing, hiring, equipment upgrades, and even basic retention systems get sacrificed. Eliminating “bad debt” restores footwork and control.

Credit Repair & Access to Capital

For small businesses, personal credit is often inseparable from business credit. Research indicates that most small businesses rely on personal credit in some capacity, and personal credit scores can influence access to financing and underwriting decisions.[8] A frequently cited SBA-commissioned report (2006) is referenced by multiple outlets as finding that a large share of banks used owner credit scores in underwriting for small business loans; this illustrates why credit strength is a practical business asset, not vanity.[9]

Personal Guarantees Are Common

Personal guarantees are a defining characteristic of small business borrowing. The Federal Reserve Small Business Credit Survey (employer firms) reports that a majority of firms used personal guarantees as collateral to secure debt.[10] A Bankrate explainer citing Federal Reserve Small Business Credit Survey findings also notes that personal guarantees are common among small businesses seeking credit.[11]

Debt Leveraging (Strategic Borrowing)

Debt is a tool when it is strategic. Leaders who borrow with a clear ROI plan—expansion timing, marketing conversion systems, staffing, retention—use leverage to build capacity. Leaders without a plan borrow reactively, and interest becomes the chokehold.

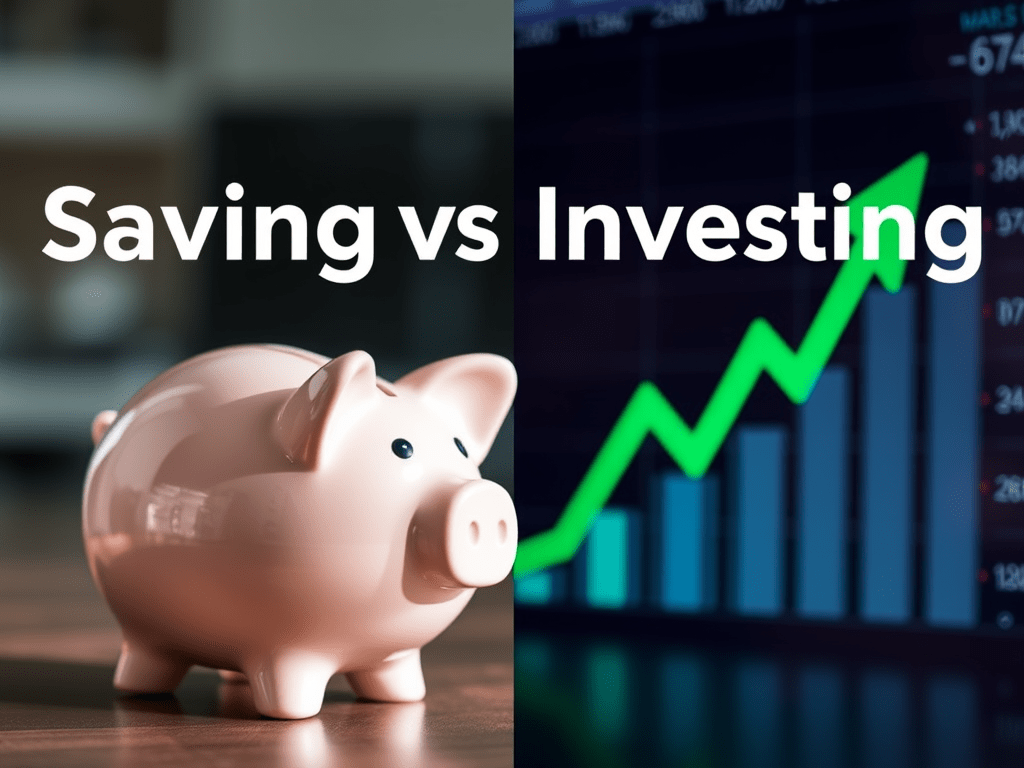

Financial Attack: Savings, Retirement, Legacy (Offense)

Savings & Reserves

Reserves are the difference between responding calmly and panicking under pressure. Disruptions happen: seasonal enrollment dips, facility issues, unexpected health events, and economic tightening. Schools with a financial system and reserves can continue operating while adapting. Pandemic-era martial arts industry accounts emphasize this difference between businesses that perished, businesses that survived, and businesses that expanded.[3]

Retirement Planning: Do Not Make Your Dojo Your Only Exit Strategy

Many owners delay retirement planning while building the business. SCORE’s retirement infographic reports that 34% of entrepreneurs have no retirement savings plan for themselves, and it also reflects the risk of relying on a future business sale as the primary retirement strategy.[12] SCORE’s press release about the infographic reiterates these concerns and frames the urgency for business owners to prepare for retirement in a disciplined way.[13]

Legacy Planning

Legacy planning goes beyond “what happens if I die” and extends into stewardship: what happens when I want to step back, transfer leadership, or expand into new ventures. Gallup’s work on succession planning illustrates how often owners lack formal plans, particularly among nonemployer businesses, which make up a massive share of U.S. firms.[7] Offense in this area means you choose your transition instead of being forced into one.

With a Plan vs. Without a Plan (General Case Study Contrast)

Martial Arts Leader / Business Owner With a Plan

- Builds a protection “stance”: life insurance, legal posture, and estate/succession documentation.[5][7]

- Maintains disciplined movement: debt elimination strategy, credit improvement, and intentional leverage.

- Understands capital realities: personal credit and personal guarantees often influence funding access.[8][10]

- Builds reserves and plans retirement beyond the business alone.[12]

- Can adapt during disruption, and is positioned to grow when others retreat.[3]

Martial Arts Leader / Business Owner Without a Plan

- Is exposed: one lawsuit, health event, or shutdown can become catastrophic without preparation.

- Borrowing becomes reactive; interest payments reduce strategic capacity and amplify stress.

- Credit weakness limits options; personal guarantees can increase personal risk when debt is taken on without a plan.[10]

- Retirement becomes “someday” and often defaults to “I’ll sell the business,” despite real market uncertainty.[12]

- Legacy and succession remain undefined—leaving the future of the dojo, clients, staff, and family uncertain.[7]

This is why the “Offense is Defense” philosophy matters: you don’t wait for crisis to force a lesson. You train the system ahead of time.

Call to Action

Offense is Defense. Build your Financial Stance. Master your Financial Movement. Execute your Financial Attack.

Replace the links below with your own:

Watch the Interactive Video Schedule a Complimentary Review

Educational content only. Insurance and financial strategies vary by individual situation. Consult appropriately with Jason D Murry & his licensed professionals.

Sources (Hyperlinked)

- U.S. SBA Office of Advocacy — Frequently Asked Questions About Small Business (2024 PDF). https://advocacy.sba.gov/…/Frequently-Asked-Questions-About-Small-Business_2024-508.pdf

- U.S. Bureau of Labor Statistics (TED) — 34.7 percent of business establishments born in 2013 were still operating in 2023. https://www.bls.gov/opub/ted/2024/34-7-percent-of-business-establishments-born-in-2013-were-still-operating-in-2023.htm

- MAIA Hub — Life During Wartime: How 7 Martial Arts Schools Overcame the Odds and Triumphed While COVID Attacked. https://www.maiahub.com/…/life-during-wartime-how-7-martial-arts-schools-overcame-the-odds…

- Martial Arts Museum (press release) — The Businesses Most Damaged by the Covid Lockdown, the Martial Arts Schools. https://mamuseum.cms.ipressroom.com/…/the-businesses-most-damaged-by-the-covid-lockdown-the-martial-arts-schools

- Investopedia — Key Person Insurance: Essential Guide for Businesses. https://www.investopedia.com/terms/k/keypersoninsurance.asp

- Guardian Life — A Guide to Key Person Life Insurance. https://www.guardianlife.com/life-insurance/key-person

- Gallup — Most Small-Business Owners Lack a Succession Plan. https://news.gallup.com/poll/657362/small-business-owners-lack-succession-plan.aspx

- Consumer Financial Protection Bureau (paper) — How Much Do Small Businesses Rely on Personal Credit? (Fonseca & Wang). https://files.consumerfinance.gov/…/cfpb_2022-research-conference_session-6_fonseca-wang_paper.pdf

- The Vant Group — How Personal Credit Affects Small Business Borrowing (cites SBA 2006 report re: bank use of owner credit scores). https://www.thevantgroup.com/how-personal-credit-affects-small-business-borrowing/

- Federal Reserve System — 2020 Small Business Credit Survey: Employer Firms Report (notes personal guarantees commonly used as collateral). https://www.fedsmallbusiness.org/…/2020/2020-sbcs-employer-firms-report.pdf

- Bankrate — Personal Guarantee for a Business Loan (citing Federal Reserve Small Business Credit Survey). https://www.bankrate.com/loans/small-business/personal-guarantees/

- SCORE — Infographic: Small Business Retirement — Investing in Your Future. https://www.score.org/resource/infographic/infographic-small-business-retirement-investing-your-future

- PR Newswire — One-Third of Small Business Owners Lack a Retirement Savings Plan (SCORE infographic release). https://www.prnewswire.com/…/one-third-of-small-business-owners-lack-a-retirement-savings-plan-300833644.html