Retirement; [Not an Age But a Number] is a milestone that many of us look forward to, but it can also be a source of uncertainty. Will you have enough savings to maintain your desired lifestyle? How can you ensure financial security for yourself and your loved ones? These questions can be overwhelming, but with the right guidance, you can confidently stride towards a comfortable retirement.

At J. Murry Financial, we understand the importance of retirement planning, and we’re here to help you navigate this journey. Our team of experts, led by professionals like Jason D. Murry, specializes in life insurance, annuities, and income planning for retirement. With their educational and informative approach, they empower individuals like you to make informed decisions about your financial future.

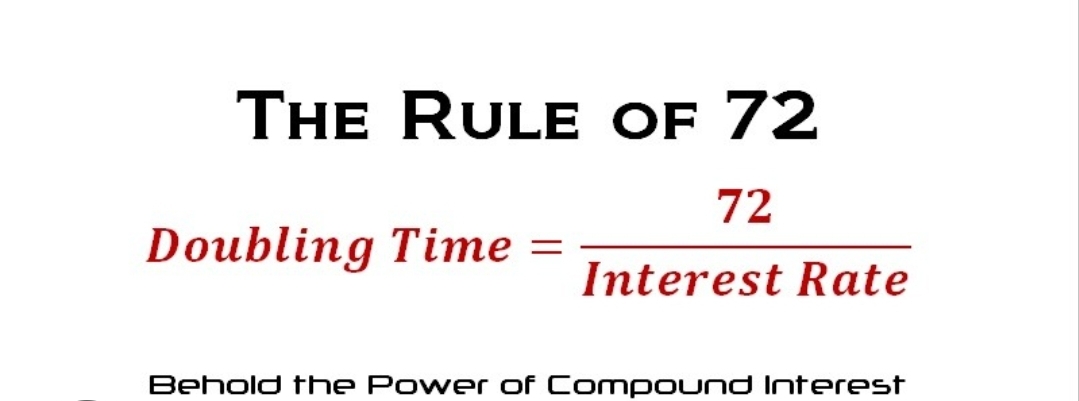

One of the key tools we utilize is the Financial Intelligence Number (FiN). FiN is not just a number; it’s a mirror reflecting your retirement aspirations and how prepared you are to achieve them. By taking a deep dive into your personal financial snapshot, FiN provides valuable insights tailored to your unique circumstances. It considers factors like rising living costs and unexpected expenses, giving you a ballpark of what you’ll need to maintain or achieve your desired retirement lifestyle.

With FiN as your guide, you can engage in open-ended discussions about daily budgeting, long-term investments, and understanding your 401k. It becomes the foundation for essential conversations that shape your retirement strategy. Our team of experts, including Jason D. Murry, utilizes FiN to quickly grasp your financial story and offer invaluable insights to ensure you’re on the right path.

But FiN doesn’t stop there. When combined with modern technology, its potential is truly transformative. AI-driven tools analyze vast amounts of data to create hyper-personalized content that speaks directly to your unique financial narrative. You can even simulate real-life financial scenarios to understand the impact of major decisions on your retirement.

At J. Murry Financial, we believe in the power of storytelling and real-life examples. We’ve witnessed firsthand how proactive retirement planning, supported by tools like FiN, can make a tangible difference in people’s lives. Our success stories and case studies begin with how individuals and families have achieved financial security and peace of mind through our comprehensive insurance product.

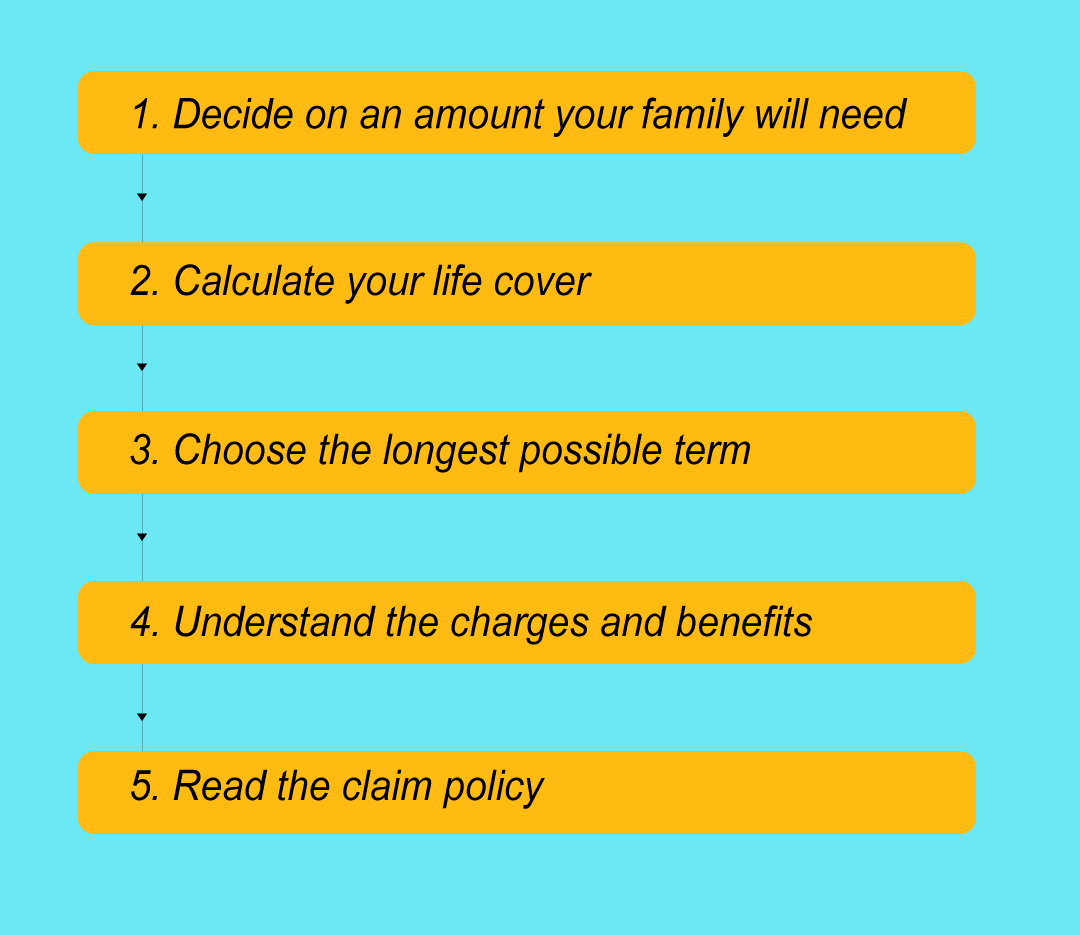

Speaking of insurance products, J. Murry Financial offers a range of options to protect your financial future. Our term life insurance with living benefits is a popular choice, providing both death benefit protection and potential financial support during your lifetime. It’s a flexible and affordable solution that ensures your loved ones are taken care of, even in the face of unexpected events.

In addition to term life insurance, disability insurance, critical illness insurance, and long-term care insurance. Each product is designed to address specific needs and provide comprehensive coverage for different stages of life. Our team of experts, led by professionals like Jason D. Murry, can guide you in choosing the right insurance solutions that align seamlessly with your retirement goals.

Once the foundation of your life insurance needs are practically established and satisfied, Jason D. Murry and our team of experts can point in the right retirement platform whether it’s annuities, short term liquid assets, long term growth assets, well managed portfolios, or other retirement assets, we’ve got you best interest establishing wants and needs for a secure comfortable retirement and legacy program.

So, if you’re ready to take control of your retirement and secure your financial future, J. Murry Financial is here to support you every step of the way. Join our community of individuals who are committed to achieving financial freedom and making a positive impact on their lives and the lives of their loved ones. Contact us today to unlock your FiN and pave the path to a secure retirement. #RetirementPlanning #FinancialSecurity #JMurryFinancial #RetirementLegacy #BuildingALegacy

Click the link to Unlock Your FiN NOW: https://discoverfin.io/en?id=finjas22oq